This Year Could Be Stellar for Silver Prices

If there’s one asset that investors shouldn’t ignore in 2024, it’s silver. The gray precious metal is selling at a massive discount, and silver prices could make a big run toward $50.00 an ounce this year. Being patient could result in immense returns.

Why have such a bullish outlook on silver in 2024?

There are some interesting developments in the silver market that are currently being overlooked by investors. Once these developments become common knowledge, you can say goodbye to the suppressed price of silver.

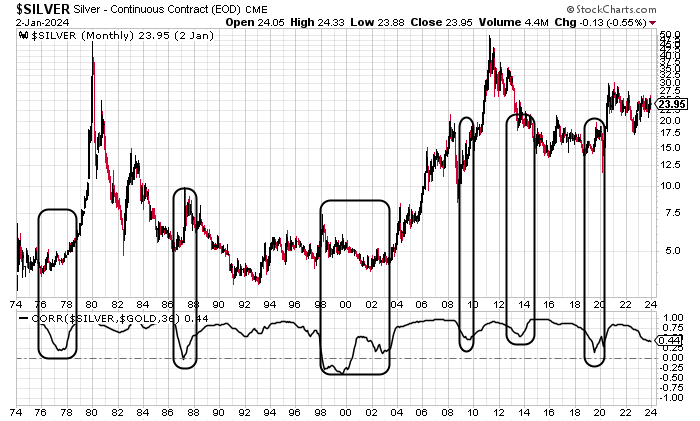

Take a look at the chart below. It plots silver prices at the top (the red/black line) and the correlation between silver and gold prices at the bottom (the black line) over a three-year period.

Correlation tells us how closely the prices of two assets (gold and silver, in this case) move together.

If two assets have a high positive correlation (near 1), it means that, when the price of one of the assets goes up, the price of the other one tends to go up as well. On the other hand, if they have a high negative correlation (near -1), when the price of one of the assets goes up, the price of the other one typically goes down.

Chart courtesy of StockCharts.com

As the above chart shows, over the long term, the correlation between silver prices and gold prices is very high. At times, the price movement of the two metals even becomes perfectly correlated.

But here’s something you need to know: over the past 50 years, whenever the correlation between gold and silver prices dropped below 0.5, it was one of the best times to own the gray precious metal. This only failed once in the past 50 years, in 2013–2014.

The gold-silver correlation has dropped below 0.5 again, and one has to wonder if the silver is again presenting a great buying opportunity.

This Ratio Says Silver Prices Could Double

Don’t stop there: take a look at the gold-to-silver ratio chart below.

This ratio shouldn’t be a new concept for long-term readers of Lombardi Letter. The gold-to-silver ratio shows how many ounces of silver it takes to buy one ounce of gold. For instance, a reading of 10 would mean it would take 10 ounces of silver to buy one ounce of gold.

Precious metal investors use this ratio to assess the value of silver.

Here’s something else that needs to be noted: whenever the gold-to-silver ratio drops below 40, silver enters overvalued territory. Whenever the ratio goes above 80, silver enters undervalued territory. The higher the gold-to-silver ratio goes above 80, the more undervalued silver is.

This key valuation measure currently suggests that silver trades for pennies on the dollar.

Chart courtesy of StockCharts.com

If the gold-to-silver ratio goes down to 40 and gold prices remain around $2,050 an ounce, silver prices will likely surge to $51.25 an ounce. That would be about 114% above the current price of silver.

Where’s the Investment Opportunity When Silver Prices Soar?

Dear reader, the price of silver hasn’t performed very well over the past few months, and this might be causing some investors to ignore the gray precious metal. Speaking from experience, beaten-down assets are usually ignored.

However, I continue to believe that silver prices could go a lot higher and that patient investors could generate the biggest returns.

Where could investors get the biggest returns?

I believe that, as silver prices move higher in 2024 and beyond, mining companies could do really well. It wouldn’t be shocking to see the prices of certain silver mining stocks double, triple, or more as the price of silver makes a run toward my long-term target of $50.00 an ounce.

I must say, however, that not all silver mining companies are created equal. When silver prices start moving higher, it’s usually very common for bad ideas to surface. Some miners don’t make money in the long run.

When selecting mining companies to invest in, it’s important to focus on the quality of their assets, as well as their production costs, balance sheets, and management teams.